Mutual of Omaha offers a selection of life insurance policies to choose from including term life insurance, whole life, universal life, children's whole life insurance, and accidental death insurance. You have the option to speak with an agent in your area if you prefer, but Mutual of Omaha also lets you get a free quote or apply for any of its policies online. Mutual of Omaha also offers term and whole life coverage options with no medical exam, although not all applicants will qualify.

Buckle up with State Farm, and get auto insurance in Altavista, VA that fits your needs. You've got plenty of options — from collision and comprehensive to rental and rideshare. If you need more than an auto policy for the family, we provide car insurance coverage for new drivers, business travelers, collectors, and more. Not to mention, State Farm is the largest auto insurance provider in the U.S.1 You could even save more by combining the purchase of auto and home policies. Buckle up with State Farm, and get auto insurance in Chattanooga, TN that fits your needs. State Farm was founded in June 1922 by retired farmer George J. Mecherle as a mutual automobile insurance company owned by its policyholders.

The firm specialized in auto insurance for farmers and later expanded services into other types of insurance, such as homeowners and life insurance, and then to banking and financial services. To find the best car insurance for you, figure out your budget plus how much and what kind of coverage you need. Then get quotes from top national insurers and smaller regional companies for the same level of coverage. Consider each insurer's price, customer service ratings and coverage options.

Make sure you understand what's included with each policy, including perks and discounts. With many insurers offering similar levels of customer service and types of coverage, rates should definitely factor into your decision. If you're shopping for the cheapest possible car insurance, we found that Erie has the most affordable rates on average. Our review process gave preference to companies that offered online quoting tools and transparent pricing. We also looked at the functionality, such as online forms and customer portals, offered by carriers for customers to manage their policies and file claims online.

Companies that offered multiple forms of customer service, such as phone, email, and live chat through their websites, also received ratings boosts. When it comes to the life insurance products it offers, State Farm lets consumers purchase term life insurance coverage, whole life insurance, and universal life insurance. State Farm also makes it easy to enter your information and get a free quote online for term life.

In order to compile our list of the best life insurance companies, we researched and evaluated more than two dozen different life insurance companies. We gathered data about each company, including ratings for financial strength , customer satisfaction scores (using J.D. Power ratings), as well as pricing and customer experience. Northwestern Mutual offers term life insurance coverage, whole life insurance coverage, and universal life insurance coverage.

However, due to the fact it employs financial advisors who oversee your full financial picture, you will need to go through a complete financial review to get a quote. State Farm extends instant answer term life insurance coverage you can apply for online, and these policies can be purchased with no medical exam. You do have to answer health questions in your application, however.

Some Business Owners policies are underwritten by Progressive. These guidelines will determine the company quoted, which may vary by state. The company quoted may not be the one with the lowest-priced policy available for the applicant.

Certain Progressive companies may be compensated as licensed agencies for performing services on behalf of the Business Owners, General Liability, Professional Liability and Workers' Compensation insurers. Progressive assumes no responsibility for the content or operation of the insurers' websites. Prices, coverages, privacy policies and compensation rates may vary among the insurers.

Like you, our agents are small business owners who know the importance of developing a plan for continued financial security. As it grows, make sure you have the right business insurance products for your business. When it comes to life insurance coverage, USAA offers term life insurance coverage for up to 30 years as well as permanent life insurance products that last a lifetime. It also makes it possible to get a free quote for both term and permanent coverage online, which means it is more transparent on pricing than many of its competitors. State Farm is one of the country's largest providers of life and property insurance. The company has several subsidiaries, a variety of services including financial advisement, home and car loans, boat and auto insurance, retirement services, credit cards, and more.

State Farm is headquartered in Bloomington, IL, and its services are offered to customers throughout North America. We've made our recommendations based on insurers that are widely available throughout the country. However, some of the best and cheapest insurers for drivers are locally based. Compare the car insurance companies with the best customer service reputations and affordability near you. Unless the practice is banned in your state, your credit score can have a major impact on the price of your auto insurance policy.

Every insurer calculates its own credit-based insurance score and uses it to adjust its base rates. In many cases, drivers with poor credit pay twice as much for car insurance as individuals with an excellent credit score. A rider is a life insurance policy enhancement that offers additional benefits or custom coverage options to the insurance policy.

This may include coverage for a spouse or children, additional payouts for accidental death, or the ability to access policy funds early. Rider fees are typically billed as a small percentage of the policy premium or as a flat annual fee. USAA auto and home insurance and banking products are only available for military members and veterans, but it's life insurance products are available to the public. USAA boasts excellent ratings for financial strength, and it offers an array of riders you can add to your policy to bolster your benefits. Finally, USAA focuses primarily on military members, so it understands the lifestyle and risks and can make the underwriting process easier as a result.

Mutual of Omaha offers term and whole life insurance policies with no medical exam for applicants who qualify. This means you may be able to fill out a health questionnaire from the comfort of your home, with no invasive health exam, and get coverage when you pay your first month's premiums. Transamerica has you speak to an agent in order to get a quote for most of its life insurance products. Its premiums for term coverage tend to be an excellent value. To learn more about Transamerica Life Insurance check out our full review below.

The best way to quickly assess an insurance company's financial stability is through a financial strength rating from professional analysts. AM Best, a credit rating agency, independently assesses the ability of insurance companies to pay their claims and rates them on a traditional grading scale from A++ to D-. An A- rating or higher indicates an excellent or superior ability to pay claims. USAA is a provider of insurance and banking products for U.S. military members and veterans.

New York Life offers four main types of life insurance coverage—term life insurance, whole life, universal life, and variable universal life. It also offers an array of helpful life insurance resources on its website, as well as charts that can help you compare its policies and offerings. Prudential was chosen as the best life insurance company overall based on the company history dating back to 1873, the broad selection of policies available, and excellent ratings for financial strength.

We've grown from a small mutual auto insurance company, owned by policyholders who spent their days farming in Ohio, to one of the largest insurance and financial services companies in the world. Apart from offering P&C insurance, State Farm subsidiaries and affiliates provide life and health insurance, annuities, mutual funds and banking products. In 2020, the firm was ranked 36th on the Fortune 500 list of largest companies. It has approximately 58,000 employees and sells its products through a 19,000-strong force of independent contractor exclusive State Farm agents.

State Farm is best known for offering property and casualty (P&C) insurance products, especially in personal lines. According to SNL Financial Data, State Farm insures more cars and homes than any other insurer in the US. As you experience changes in your life, your health insurance coverage should adjust as well. Let State Farm help you find the right policy for health insurance in Altavista, VA. We offer a variety of affordable supplemental health, Medicare supplement, or individual medical coverage plans. You may even protect your paycheck with disability insurance to help cover monthly expenses.

Let State Farm help you find the right policy for health insurance in Chattanooga, TN. We offer a variety of affordable supplemental health, Medicare supplement, or individual medical coverage plans. State Farm customers can call SFCLAIM or submit a claim through the company's mobile app or online at statefarm.com/claims. Customers can also text the word "CLAIM" to to receive a link to file a claim. Because of the ongoing pandemic, which hit a new record for daily cases in Colorado on the same day as the fire, many insurance companies try to handle as much as they can virtually. ValuePenguin assigned its editor's ratings for insurance companies based on customer service, affordability, coverages offered and the shopping experience. Beyond its service and rates, USAA also offers discounts that cater to the lifestyles of service members.

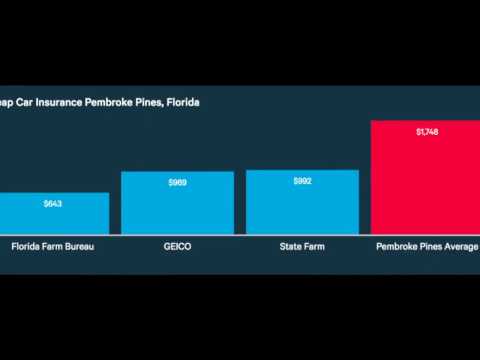

If your vehicle is garaged on a military base, you can get a discount of 15% on the cost of comprehensive insurance. With State Farm, drivers don't have to pay more for excellent customer service. It is one of the most affordable large insurance companies in our sample. A full coverage policy costs $1,310, 41% less than the national average.

The best car insurance company in your area or for your situation may not always be a large auto insurer. We have identified three great insurance companies with a more limited reach — NJM, Auto-Owners and Erie. Guaranteed-issue life insurance policies are a type of permanent life insurance that offers guaranteed approval for a small amount of coverage, regardless of the applicant's health status. No medical exam is required for approval of coverage. We chose State Farm as the best company for instant issue policies based on the fact you can apply online and get term life coverage without a medical exam or any hoops to jump through.

State Farm's excellent ratings and long history also helped it gain a spot in our ranking. Today we still answer to our members, but we protect more than just cars and Ohio farmers. We're a Fortune 100 company that offers a full range of insurance and financial services across the country. Including car, motorcycle, homeowners, pet, farm, life and commercial insurance. As well as annuities, mutual funds, retirement plans and specialty health services.

Blue Cross Blue Shield Association is an association of independent Blue Cross and Blue Shield companies. Blue Cross Blue Shield Association is not a health insurance company and does not sell health insurance. Blue Cross Blue Shield health insurance is provided by your local, independent Blue Cross and Blue Shield companies and is marketed through authorized State Farm agents. Neither State Farm Mutual Automobile Insurance Company nor any of its subsidiaries or affiliates are financially responsible for these products.

If you are interested in select term products, please proceed by locating the Get a quote for term life insurance link at the top of this page. If further questions or you are interested in additional types of life products, contact a State Farm® agent. We collected auto insurance quotes across 50 states and the District of Columbia to determine average rates. Our base driver was a 30-year-old male who drove a 2015 Honda Civic EX, and quotes were drawn from all available ZIP codes in each state. Quotes were for a full coverage policy unless otherwise noted.

An insurer is not included in the best companies list unless it does business in at least five states. Power claims satisfaction or AM Best financial strength, it's because they were not rated. Power's annual survey rates insurance customer satisfaction out of 1,000 points. We calculated the average score across all available regions. The most important factor to consider when shopping for insurance is the customer service experience.

If you have to make a car insurance claim, you can expect some extra costs and headaches, and you will want a company that guarantees a smooth claims process. He makes $100,000 per year as the sole breadwinner, and they carry $500,000 in debt ($450,000 mortgage and $50,000 in auto loans). John has decided to get 10x his salary in term life insurance coverage, plus another $500,000 to cover their debt obligations. Term coverage allows him to obtain coverage for a specific amount of time , for the lowest monthly cost. Northwestern Mutual has been in business since 1857, and it has solid ratings that show its commitment to offering quality products and services.

Not only does Northwestern Mutual boast an A++ rating from AM Best and an AA+ rating from S&P Global, but it also earned high marks for customer satisfaction in the J.D. Prudential does let you apply for an instant online quote for term life insurance. To learn more about life insurance from Prudential, have a look at our full review. Life insurance is a great way to protect your family financially in the event of your death. Term life insurance can provide you and your family with long-lasting financial security. You determine how much coverage you need, how long you need it, who you'd like covered, and when you pay—giving you control of your policy.

State Farm Insurance Corporate Office Phone Number From customized auto insurance to superior claims service, our people and technology will support you every step of the way. Join us today and experience why we're one of the best insurance companies. The bank opened in May 1999 and is operated by State Farm Financial Services, FSB, a subsidiary of State Farm Mutual Automobile Insurance Co. Home mortgages are available countrywide over the phone or through agents. Do you have important treasures like collectibles, jewelry, sports equipment, and others?

Your homeowners or renters insurance policy may limit coverage on some of your most valuable items. Renters' insurance coverage1 even extends to personal property in your car. Renters insurance typically covers losses to your personal property caused by fire, smoke damage, sudden and accidental covered water damage, thefts, burglaries, vandalism or vehicle damage. Please remember that the preceding descriptions contain only a general description of available coverages and are not a statement of contract.

All coverages are subject to all policy provisions and applicable endorsements. To learn more about auto insurance coverage in your state, find a State Farm agent. Maybe you want more than the policy for the family car. State Farm provides car insurance coverage for new drivers, business travelers, collectors and more. Before changing insurance companies, make sure the policies you're comparing offer the same coverage and terms. Knowing how auto insurance is priced can help you decide if you're getting your money's worth from your current or new policy.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.